Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.

This Presentation Deck seeks to explain the key provisions of PMLA and also to allay the fears of Professionals who have been expressing their deep concerns, if not hue and cry, over the recent notification dated […]

All views stated are my personal views, they are not binding on ICAI/Study Circle. My personal views may be correct/incorrect as they are expressed based on my understanding of the subject. All members/listeners […]

Notification No 05/2022 dated July 13, 2022, applicable from July 18, 2022

I have been curiously and incisively watching and analysing, threadbare, the insightful discussions pertaining to the applicability of […]

Government of India vide Finance Act 2021, has introduced a new section 206AB under the Act wherein a buyer is responsible to deduct TDS at a higher rate (i.e., twice the rate as specified under the relevant […]

I have in this article attempted to explain the changes in HSN Reporting from May 2021 in GSTR 1, as I feel that many members may have questions in respect of the same. This is an effort to address and […]

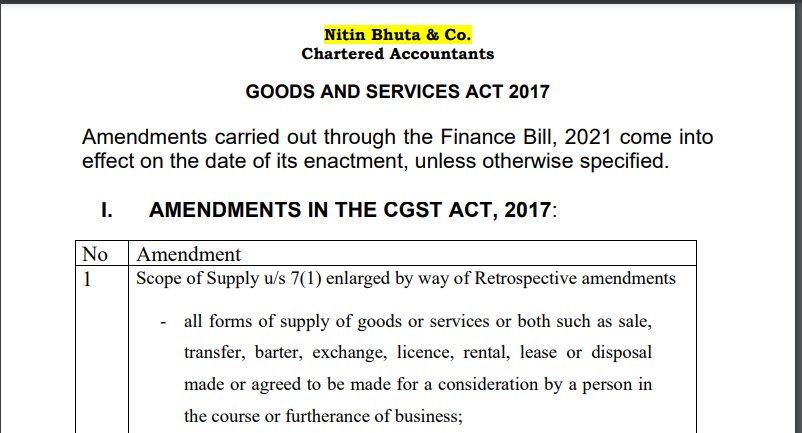

Indirect Tax Amendments by Finance Bill 2021

Amendments carried out through the Finance Bill, 2021 come into effect on the date of its enactment, unless otherwise specified.

I. Amendments In The CGST Act, […]

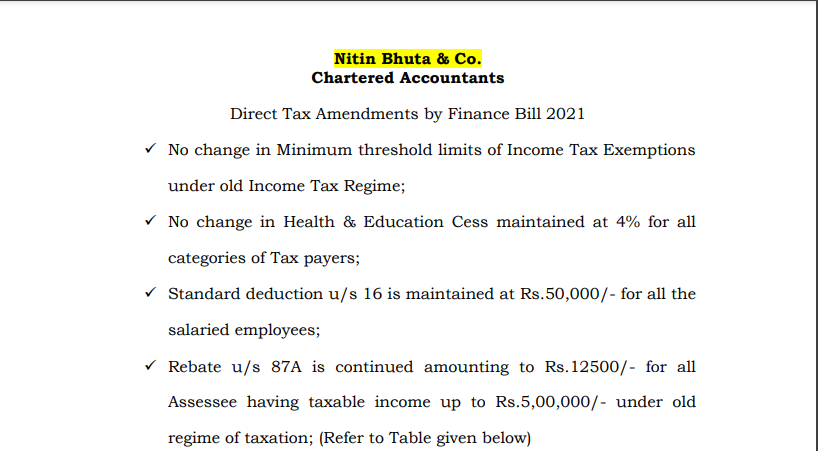

No change in Minimum threshold limits of Income Tax Exemptions under old Income Tax Regime;

No change in Health & Education Cess maintained at 4% for all […]

Light!! Camera!! Action!! – Bad Debts Dichotomy

In this article, I have invoked the concept of “Light!! Camera!! Action !!” which is the catchy “call-phrase” used in the Entertainment Industry to get everyone […]

Input Tax Credit under Section 16 (2) – The Etymology of Double/Triple Jeopardy (???)

Informally, it is called the “Double Whammy” or the “Triple Whammy” – I write this article to put forth an instance of […]

Era refers to common practices adopted for doing a Trade-in Inbound as well as Outbound territories of the Countries;

Inbound refers to the trade done […]

39TH GST COUNCIL PROPOSALS 14/03/2020

INTEREST LIABILITY

INTEREST FOR DELAY IN PAYMENT OF GST TO BE CHARGED ON THE NET CASH TAX LIABILITY W.E.F. 01.07.2017

Law to be amended retrospectively. Most welcome change […]

The Direct Tax Vivad Se Vishwas Scheme Finance Bill 2020

Objective

•The intention was to resolve the disputed tax dues filed at all various adjudication levels due to the pendency of appeals at various ap […]

Draft reply on 36(4) notices

(Disclaimer: It is just a draft, please take professional help while making a formal reply. It is only for educational purposes)

Date…………………

To, Proper Officer, Range…………………… […]

Nitin Bhuta

@nitin-bhutagmail-com

active 5 years, 4 months agoNitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.

OOPS!

No Packages Added by Nitin Bhuta. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewNitin Bhuta wrote a new post, PMLA Notification – Not the Armageddon you think 2 years, 9 months ago

This Presentation Deck seeks to explain the key provisions of PMLA and also to allay the fears of Professionals who have been expressing their deep concerns, if not hue and cry, over the recent notification dated […]

Nitin Bhuta wrote a new post, Refund of GST Unregistered Persons Cir. No 188/20/2022-GST dated 27.12.2022 3 years, 1 month ago

All views stated are my personal views, they are not binding on ICAI/Study Circle. My personal views may be correct/incorrect as they are expressed based on my understanding of the subject. All members/listeners […]

Nitin Bhuta wrote a new post, GST on Rent Compensation – Residential Property 3 years, 7 months ago

Notification No 05/2022 dated July 13, 2022, applicable from July 18, 2022

I have been curiously and incisively watching and analysing, threadbare, the insightful discussions pertaining to the applicability of […]

Nitin Bhuta wrote a new post, Section 206AB changes as applicable from July 1, 2021 – Declaration on the filing of the tax return for past years and linking of PAN with Aadhaar 4 years, 9 months ago

Government of India vide Finance Act 2021, has introduced a new section 206AB under the Act wherein a buyer is responsible to deduct TDS at a higher rate (i.e., twice the rate as specified under the relevant […]

Nitin Bhuta wrote a new post, New Revised Due dates under Income Tax Act 1961 AY 21-22 4 years, 9 months ago

Extension of various dates like TDS Returns, SFT, ITR, TAR, TP Audit, etc. –

Circular No 9 dated 20.05.21 – The assessment Year 2021/22

Sr No.

Nature of Extension

Original due date

New Due Dates […]

Nitin Bhuta wrote a new post, HSN Reporting Changes 4 years, 9 months ago

I have in this article attempted to explain the changes in HSN Reporting from May 2021 in GSTR 1, as I feel that many members may have questions in respect of the same. This is an effort to address and […]

Nitin Bhuta wrote a new post, Indirect Tax Amendments by Finance Bill 2021 5 years ago

Indirect Tax Amendments by Finance Bill 2021

Amendments carried out through the Finance Bill, 2021 come into effect on the date of its enactment, unless otherwise specified.

I. Amendments In The CGST Act, […]

Nitin Bhuta wrote a new post, Direct Tax Amendments by Finance Bill 2021 5 years ago

Direct Tax Amendments by Finance Bill 2021

No change in Minimum threshold limits of Income Tax Exemptions under old Income Tax Regime;

No change in Health & Education Cess maintained at 4% for all […]

Nitin Bhuta wrote a new post, Light!! Camera!! Action!! – Bad Debts Dichotomy 5 years, 2 months ago

Light!! Camera!! Action!! – Bad Debts Dichotomy

In this article, I have invoked the concept of “Light!! Camera!! Action !!” which is the catchy “call-phrase” used in the Entertainment Industry to get everyone […]

Nitin Bhuta wrote a new post, Lock Stock and Barrel – of Debit and Credit Notes with Tax Invoices under GST 5 years, 3 months ago

Lock Stock and Barrel – of Debit and Credit Notes with Tax Invoices under GST

Parable of Not a Penny More and Not a Penny Less

In this article, an attempt has been made to correlate two popular maxims – “lock […]

Nitin Bhuta wrote a new post, Input Tax Credit under Section 16 (2) – The Etymology of Double/Triple Jeopardy (???) 5 years, 3 months ago

Input Tax Credit under Section 16 (2) – The Etymology of Double/Triple Jeopardy (???)

Informally, it is called the “Double Whammy” or the “Triple Whammy” – I write this article to put forth an instance of […]

Nitin Bhuta wrote a new post, TCS Provisions – Goods Related w.e.f October 1, 2020, Under Income Tax Act 1961 5 years, 5 months ago

TCS Provisions – Goods Related w.e.f October 1, 2020, Under Income Tax Act 1961

Objective

To expand the scope of provisions relating to Tax collection at source;

To monitor disclosure of transactions in t […]

Nitin Bhuta wrote a new post, HSN Classification at Surat ICAI on 23.02.2020 5 years, 7 months ago

Era Before The Introduction of HSN Classification

Era refers to common practices adopted for doing a Trade-in Inbound as well as Outbound territories of the Countries;

Inbound refers to the trade done […]

Nitin Bhuta wrote a new post, Conceptual Framework GSTR 9 and 9C Financial Year 18-19 5 years, 7 months ago

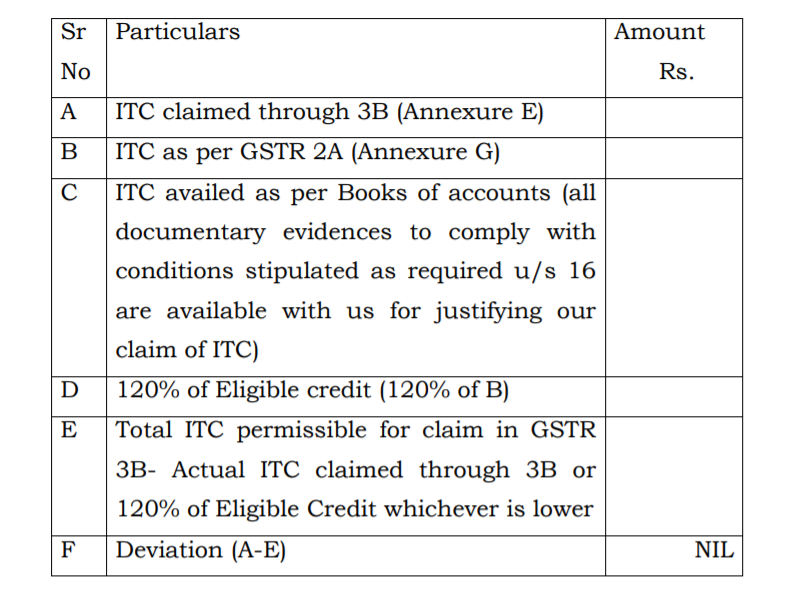

Conceptual Framework GSTR 9 and 9C Financial Year 18-19

Basic Questions

Will I see the new GSTR 9 & 9C or do I need to use old forms only?

No new form & we have to use old forms only

Will I see the […]

Nitin Bhuta wrote a new post, 39TH GST COUNCIL PROPOSALS 14/03/2020 5 years, 11 months ago

39TH GST COUNCIL PROPOSALS 14/03/2020

INTEREST LIABILITY

INTEREST FOR DELAY IN PAYMENT OF GST TO BE CHARGED ON THE NET CASH TAX LIABILITY W.E.F. 01.07.2017

Law to be amended retrospectively. Most welcome change […]

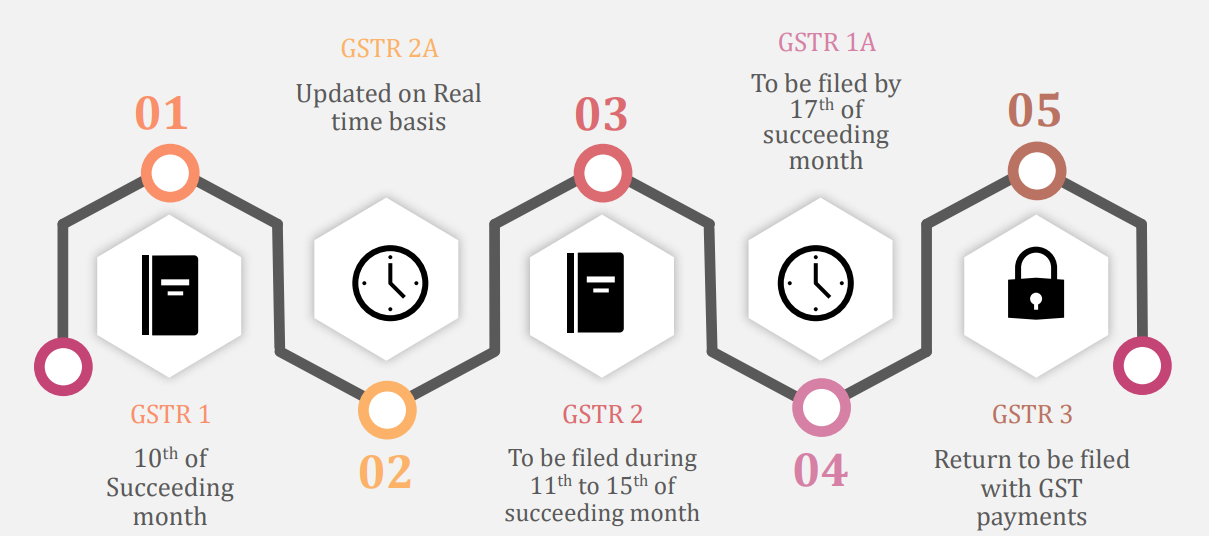

Nitin Bhuta wrote a new post, New Returns under GST 6 years ago

GST Returns – Phase I

Original GST Returns Filing Schema

Original Schema of GST Returns

GST Returns – Phase II

Alternative Returns filing option after Phase I

Advantages of New GST Returns

• In […]

Nitin Bhuta wrote a new post, The Direct Tax Vivad Se Vishwas Scheme Finance Bill 2020 6 years ago

The Direct Tax Vivad Se Vishwas Scheme Finance Bill 2020

Objective

•The intention was to resolve the disputed tax dues filed at all various adjudication levels due to the pendency of appeals at various ap […]

Nitin Bhuta wrote a new post, Draft reply on 36(4) notices: Download PDF 6 years, 1 month ago

Draft reply on 36(4) notices

(Disclaimer: It is just a draft, please take professional help while making a formal reply. It is only for educational purposes)

Date…………………

To, Proper Officer, Range…………………… […]